The session focused on key strategies for embedding customer-centric practices across all levels of an organization. Topics included assessing current customer experiences, aligning business operations with customer needs, and implementing sustainable customer-centric strategies. Participants were left with a clear roadmap for developing and executing a customer-centric strategy tailored to their organization's specific goals and challenges.

The Customer Journey Mapping took place on the 22nd and 23rd of October 2024 at the OBA office which was attended by banks where they learned both the fundamentals and the latest model to embed customer-centricity across cross-functional teams, ensuring sustainable, organization-wide immersion in customer experience. The session included hands-on group work, where participants applied their learning to create journey maps. By the end of the session, attendees were equipped to apply customer journey mapping practices effectively within their own organizations.

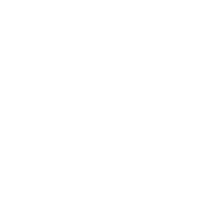

The course took place from 13th to 17th October 2024 and provided the security operatives, officers, and managers with the fundamentals of conducting effective security operations. It addressed a wide variety of topics to enable all participants to understand and practice the skills required to carry out day-to-day security functions.

The course participants gained practical skills and techniques that can be implemented immediately back in the workplace.

The session was in collaboration with Meirc Training & Consulting firm based in Dubai.

The expert Mr. Scott Livermore spoke about Global Macroeconomics with Focus on Oman under Volatile time. The Oman Economist at Oxford, Ms. Maya Senussi also joined the session online to give more focused insights on Oman.

The session was hosted by NBO and attended by the OBA treasurers committee and other members both in person and online.

During the last week of September, OBA hosted the second course in collaboration with Meric Training Institute for 5 days. The Security Policies and Procedure course was for the banking risk experts to give them a deep understanding of the policies and procedures needed for security departments within their banks. Specifically, participants discussed managing the implementation and evaluation of their policies and procedures about setting standards, staff safety, security effectiveness, and overall performance of the security department.

The Certification in Fundamentals of Security Management Course, held from September 3rd to 5th, 2024, proved to be a great success, attracting a robust group of participants primarily from the Risk Management and Information Security sectors of different banks. Over the three-day program, attendees engaged deeply with the material, gaining invaluable insights into the principles and best practices of security management. The lecturer's expertise and ability to convey complex concepts in an accessible manner significantly enhanced the learning experience, fostering dynamic discussions and networking opportunities among participants. The positive feedback received highlights the course's critical role in equipping professionals with essential skills to navigate the evolving landscape of security challenges in the banking sector.

During the course, participants explored how incident management works and how individuals and teams can successfully implement and apply principles within their organizations and/or work environments. Incident Management involves returning your organization’s everyday business safety, productivity, and overall operation, to normal as quickly as possible after an incident.

OBA in collaboration with Deloitte hosted a one-hour session with the banks on VAT strategies and compliance in the Oman Banking Sector. The session highlighted an overview of VAT in Oman; current issues and the new landscape in the banking sector, KSA/UAE VAT experiences and observations in the banking sector, and the E-invoicing experience followed by an open discussion.

On 13th May 2024, Ms. Lina Osman, the Regional Head of Sustainable Finance, West at Standard Chartered Bank hosted the OBA Academy’s Meet the Expert series to present to the members about Sustainable Financing Tools. The session was attended by several executives and CEOs from the banking sector where Ms. Lina shared her knowledge of Sustainable Financing and her experience in the field.

This virtual webinar took place on 30th March 2023 and was attended by 30 bank executives.

This virtual session took place on 30th January 2023 and was attended by 64 bank executives

This 3-day program was held from 18th to 20th December 2022 at OBA Office, 4 bank executives attended this certification program.

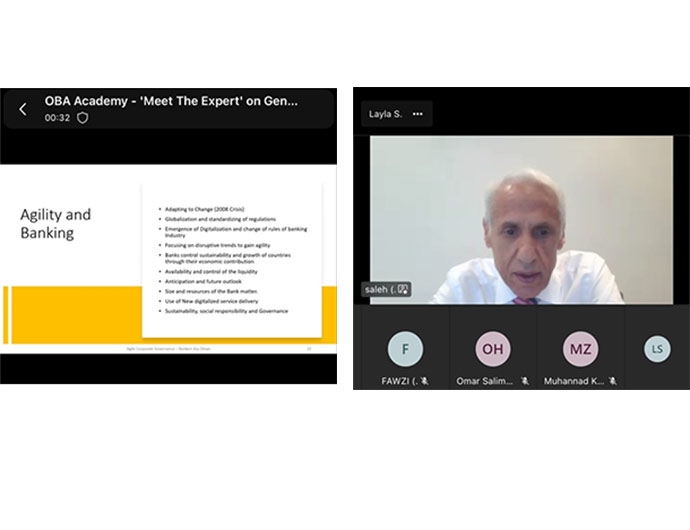

This virtual session that was requested by OBA's Compliance Committee was held on 12th December 2022 and attended by 41 bank executives.

Oman vs the US: Determinants of Interest Rates & Inflation; 15th November 2022

Meet the expert: FinTech Credit Platforms Perceived Risks Facets & Factors; 3rd November 2022.

A seminar was held on 27th July 2022 on Commercial Companies Law & the Personal Data Protection Law by Addleshaw Goddard and was attended by a number of bank executives. This event was held at First Abu Dhabi Bank (FAB1) Head Office in CBD area.

This virtual seminar took place on 23rd June 2022 and was attended by more than 20 senior bankers. The resource delivered interesting content and the presentation was followed by Q&A session.

The workshop took on 22nd June 2022 at the PDO Training Centre at Mina Al Fahal and was attended by SME bankers, entrepreneurs and SME owners, CBO, Oman Chamber of Commerce, Riyada, and Oman Vision 2040 Implementation Follow-up Unit. The workshop discussed various challenges faced by entrepreneurs and SME owners post the pandemic and the objective was creating a dialogue around the ‘pain areas’ faced by SME owners with the aim of proposing a roadmap. A number of these challenges relate to finances and interface with banks.